Direct mail triggers more consumers to recognize they need life insurance

August 2, 2018 by Insurance Forums Staff

Good news for the U.S. Postal Service! A new LIMRA study finds 23% of consumers say receiving a direct mailer sparks recognition they need life insurance.

This is the most influential method, ahead of speaking to a financial professional (15%), talking with friends and family (15%), and information received by email or at work (10% each).

The study, The Purchase Funnel — How Buyers Buy, examines the four stages of the purchase process for life insurance – from recognition of need to shopping, obtaining a quote and ultimately buying a policy.

While a mailer may spur more consumers to recognize their need for life insurance, when they begin to shop for life insurance, they tend to seek information from various distribution sources equally (online, mail, phone and in-person consultation).

As the consumer begins the process of obtaining a quote, consumers are much more likely to use online (46%) and in-person (34%) distribution platforms than purchase by phone (21%) or by mail (17%). Digging deeper, the study finds married consumers and those with dependent children are more likely to use in-person and phone to shop for life insurance. Males and females use all information sources in roughly equal proportions.

When consumers are ready to buy, they are most likely to talk to an agent or advisor in person (27%). Another quarter will call to purchase a policy (26%) and a little more than 1 in 5 will go online (22%).

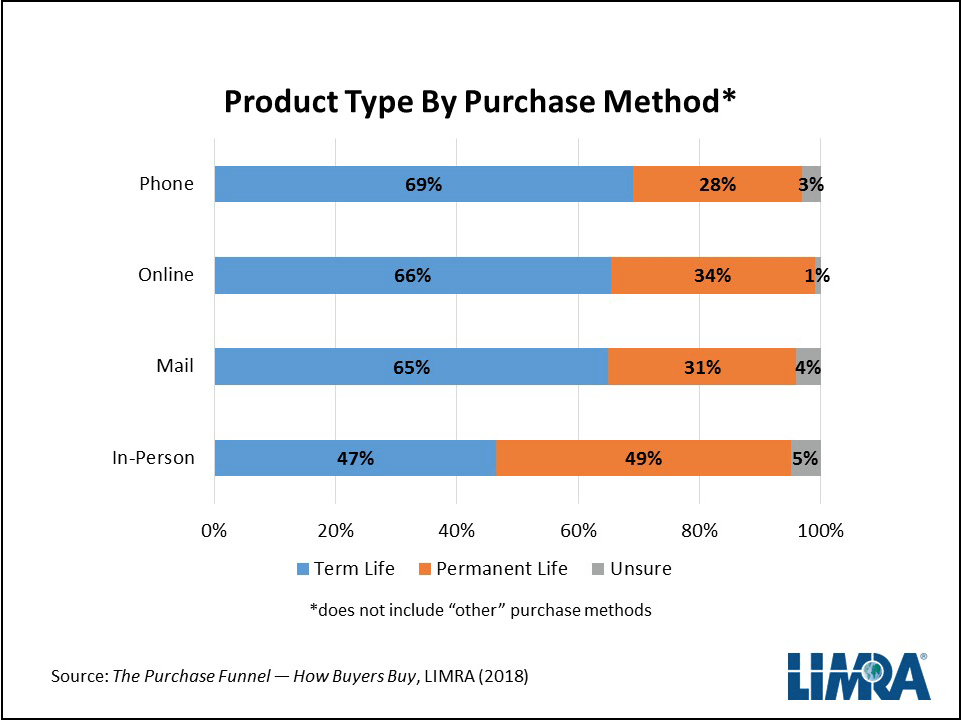

The study also examines what products consumers are more likely to buy through each distribution channel (see chart):

- In-person — Consumers buying in person are more likely to buy permanent products and more likely to buy higher coverage amounts. These buyers are more likely to be adding to coverage, and less likely to have no prior coverage.

- Online — Consumers buying through online sources are more likely to buy term products and to buy average coverage amounts. These buyers either had no prior coverage, or added to prior coverage; none of these buyers report replacing prior coverage.

- Mail — Consumers using direct mail buy term and permanent products in line with the overall average, however, they buy lower coverage amounts. All buyer types (no prior coverage, adding to coverage, or replacing coverage) are about equally likely to buy through the mail.

- Phone — Consumers buying over the phone are more likely to buy term products. The coverage levels bought by phone are similar to the overall average. There are slightly more buyers replacing prior coverage, and slightly fewer adding to prior coverage among phone.

LIMRA research shows that of the 31 million who begin the process of shopping for life insurance, less than one-third of people (just 9 million) actually purchase a policy. LIMRA estimates that 60 million Americans need life insurance coverage. Understanding the customer journey and the methods they use to gather information, get a quote and purchase a policy will help insurers and financial professionals create the right messages to engage consumers and lead them to see the process through and buy a policy.

About LIMRA: LIMRA, a worldwide research, learning and development organization, is the trusted source of industry knowledge, helping more than 600 insurance and financial services companies in 64 countries. Visit www.limra.com for more information.