New York Life Exec: Life Settlement Industry Should Strive for Standardization and Consumer Protections

{October 31st, 2013} by Angelo Lewis, Senior Associate Editor, Best's Review

NEW ORLEANS – States should work harder to institute consumer protections, standardization and methodologies when it comes to the life-settlement market, according to Scott Berlin, senior vice president at New York Life. He spoke with Best’s News Service at the American Council of Life Insurers Annual Conference in New Orleans. Q: If you could just […]

Indexed Annuities Grow New ‘Must Have’ Features

{October 31st, 2013} by Linda Koco

Guaranteed lifetime withdrawal benefit riders have been the dominant star of indexed annuity features, but they will soon share billing with several other product features, according to insurance and annuity executives. That is one takeaway from a survey conducted earlier this month by The Phoenix Companies during a National Association for Fixed Annuities (NAFA) meeting […]

Beware of ‘Office Zombies’

{October 31st, 2013} by Kevin Daum

Oh, the horror! Office Zombies abound–and they are out to destroy your workplace. Here are the various types and the ways to inoculate yourself. As we begin the annual week of All Hallows, it’s important to recognize that there are office zombies all around you. You yourself are in grave danger of becoming a monster […]

American Equity approves preliminary agreement in class action suit

{October 30th, 2013} by Maria Wood

A preliminary agreement has been reached in a class action lawsuit against American Equity Investment Life Insurance Co. involving the sale of deferred annuities to seniors. According to a statement from the Evans Law Firm, one of the law firms that represented the plaintiffs, the preliminary agreement was handed down last month in the U.S. […]

A.M. Best Affirms Ratings of Symetra Financial Corporation and Its Subsidiaries

{October 29th, 2013} by BUSINESS WIRE

OLDWICK, N.J.–(BUSINESS WIRE)–A.M. Best Co. has affirmed the financial strength rating of A (Excellent) and issuer credit ratings (ICR) of “a+” of Symetra Life Insurance Company and its subsidiary, First Symetra National Life Insurance Company of New York (New York, NY). Concurrently, A.M. Best has affirmed the ICR of “bbb+” and existing debt ratings of […]

73 will be the average retirement age for Millennials

{October 29th, 2013} by Michael K. Stanley

Student debt will play the largest role out of all the factors leading to an average retirement age of 73 for Millennials with college degrees. Although Americans of all generations of Americans are preparing to work longer due to inadequate savings coupled with an expanding life expectancy, it is student debt that is the biggest […]

New Facebook promotion possibilities for financial advisors

{October 29th, 2013} by Amy Mcllwain

Use these promotions to get people to interact with your brand and start talking about the big ideas of your business. This type of active participation can be very difficult to create with a standard Facebook timeline post. We’re always looking for new ways to help you market your financial business on social media sites. […]

What’s the most successful social network for financial advisors?

{October 28th, 2013} by Vanessa De La Rosa

It’s an awkward pairing: advisors’ hesitance to push through compliance worries and jump onto the social media bandwagon, and the incessant message that advisors must adapt to social media or risk dying off like dinosaurs. Whether you’re using social media every day, a little bit, or not all, it’s undoubtedly an ongoing source of curiosity […]

Symetra Reports Third Quarter 2013 Results

{October 24th, 2013} by Symetra Financial Corporation

Third Quarter Summary BELLEVUE, Wash., Oct 23, 2013 (BUSINESS WIRE) — — Adjusted operating income(1) was $48.9 million, or $0.42 per diluted share, up from $45.9 million, or $0.33 per diluted share, in third quarter 2012. — Net income was $45.3 million, or $0.38 per diluted share, down from net income […]

SNL: Insurers dump $3.9 billion in Treasury notes in 2013

{October 24th, 2013} by Warren S. Hersch

Led by Fidelity & Guaranty Life, U.S. insurers dispensed with nearly $4 billion in U.S. Treasuries in the first half of 2013, new research from SNL Financial reveals. Based on SNL’s review of bond transactions reported by U.S. based insurers that filed quarterly statements with the National Association of Insurance Commissioners, the report shows that […]

12 Insurers See Ratings Updates

{October 23rd, 2013} by Jennifer Morrell

A.M. Best, Fitch Ratings, Moody’s Investors Service and Standard & Poor’s (S&P’s) released ratings updates. The following are some of the most recent: Aegon N.V. Fitch has affirmed Aegon N.V.’s (Aegon) Long-term Issuer Default Rating (IDR) at ‘A’ and senior unsecured debt at ‘A-‘. Fitch has also affirmed Aegon’s primary North American life insurance subsidiaries’ […]

A.M. Best Assigns Issuer Credit and Debt Ratings to Sammons Financial Group, Inc.

{October 23rd, 2013} by Best's News Service

OLDWICK, N.J. – A.M. Best Co. has assigned an issuer credit rating of “a-” and a debt rating of “a-” to the $200 million 7.0% 30-year senior unsecured notes issued by Sammons Financial Group, Inc. (SFG, Inc.) (Delaware), an intermediate holding company indirectly owned by Sammons Enterprises, Inc. (SEI). The outlook assigned to both ratings […]

Jobs Report: US Insurance Industry Adds 2,800 Jobs in September

{October 23rd, 2013} by Jeff Jeffrey

WASHINGTON – The U.S. insurance industry added 2,800 jobs in September, continuing the upward trend in employment the industry has seen in 2013, according to the latest jobs report released by the U.S. Bureau of Labor Statistics on Oct. 22. The seasonally adjusted 0.12% increase added to the uptick in the overall jobs market. The […]

Genworth’s life division CEO to leave by year’s end

{October 23rd, 2013} by Maria Wood

Patrick B. Kelleher will leave his position as executive vice president and CEO of Genworth Financial, Inc.’s U.S. life insurance division at the end of the year, the company announced today. No reason was given in the statement for Kelleher’s departure. A spokesperson for Genworth declined to comment further on the matter. Click here to […]

Life insurance: Who needs it?

{October 23rd, 2013} by Emily Holbrook

It’s amazing to see the statistics out there that point to the lack of awareness among society about the crucial benefits afforded by life insurance. I’ll admit I was one of those who thought little (or not at all) about the product. But that was before I began working with the industry and realizing that […]

Most workers prefer one-on-one financial advice

{October 23rd, 2013} by Paula Aven Gladych

More than half of working Americans say they’d rather receive one-on-one financial advice from a financial advisor. That according to a TIAA-CREF study that showed that just 36 percent of all workers say they regularly rely on financial advice offered by their employers. TIAA-CREF’s second annual Financial Advice Survey was conducted by KRC Research and […]

Why Advisors Ignore ‘Simplified Annuities’

{October 23rd, 2013} by Linda Koco

NEW YORK CITY – “The term ‘simplified annuities’ normally means ‘watered down guarantees,’” according to a securities executive during a wide-ranging and unscripted panel discussion here at LIMRA’s annual meeting. For that reason, many advisors aren’t interested. Ultimately, everyone likes to go to simplicity, but “there isn’t a lot of demand for that,” said Robert […]

LIMRA Establishes Secure Retirement Institute

{October 23rd, 2013} by InsuranceNewsNet

NEW YORK, Oct. 22, 2013— LIMRA and LOMA President and CEO Robert A. Kerzner, CLU, ChFC, announced the establishment of the LIMRA LOMA Secure Retirement InstituteTM during his remarks at the 2013 LIMRA Annual Conference this week. “Retirement is top of mind for most Americans but our research shows that many consumers have not saved or […]

Swiss Re: “70 is the new 65”

{October 23rd, 2013} by Michael K. Stanley

Well over half of American workers surveyed (57 percent) anticipate that they will work beyond the traditional retirement age of 65 or never retire at all. The finding was uncovered in a recent Swiss Re survey timed to coincide with the beginning of National Save for Retirement Week. The survey cements the growing realization by […]

AARP: Self-actualizers more confident about finances, retirement

{October 23rd, 2013} by Warren

Proactive self-actualizers are most confident about their retirement finances and doubters are least confident, according to new research. AARP discloses this finding in an October 2013 report, “Retirement Attitudes Segmentation Survey.” The second of a two-part study to examine pre-retirees’ views of retirement, the steps they’re taking to prepare for retirement and the opportunities to […]

Countering elder financial abuse

{October 23rd, 2013} by Walter White

Nearly all of us have heard a version of this story. A stranger contacts an elderly friend or loved one by phone or a knock on the door and asks them to make a significant financial decision, offering fraudulent assurances that the senior will either make more money or receive some other benefit by taking […]

Social media insights (based on real data!) for the financial professional, Pt. 2

{October 23rd, 2013} by Jennifer DeTroye

Editor’s note: This three-part series from The American College details which prospects are on social media and exactly why advisors can no longer ignore the elephant in the room. You can read part one here. Stay tuned for part three in the next week, which will include a complimentary link to the full report. Let’s […]

Use Annuities As A Tax Shield: CPA

{October 23rd, 2013} by Linda Koco

Time was, before the era of the feature festival in annuities, agents and advisors used to present annuity options based on the client’s tax needs. According to Jeffrey Levine, certified public accountant, this may be the time to return to that strategy. Anytime there is an increase in taxes, “we’ve got to look at re-evaluating […]

Insurers “only playing at the digital game”

{October 23rd, 2013} by PR Newswire Association LLC

LONDON, Oct. 22, 2013 /PRNewswire/ — Insurance companies have high digital ambitions but have failed to take action and embrace the digital world, according to EY’s ‘Insurance in a digital world: The time is now’ survey, launched today. The survey was conducted inJuly 2013, with participants from more than 100 insurance companies. Graham Handy, EY’s Global Insurance […]

iPipeline Acquires Aplifi

{October 23rd, 2013} by IBR Staff Writer

iPipeline®, the leader in on-demand marketing, selling and processing solutions for the nation’s top insurance carriers, distributors and producers, today announced the acquisition of Aplifi®, who has maintained a strong reputation for providing life and annuity solutions to the financial services industry.* The acquisition of the Florida-based company has created the insurance industry’s most comprehensive […]

The secrets to a successful succession strategy

{October 22nd, 2013} by David Canter

Approximately 67% of firms either don’t have succession plans for their businesses or have plans that are not ready to be implemented. Is your business ready? Advisers are constantly working with clients to help in every aspect of financial health and success. They guide them in securing their future and, in some cases, assist them […]

Massachusetts Allows Insurance Producers to Charge Fees When Selling Policies

{October 22nd, 2013} by Thomas Harman, associate editor, BestWeek

BOSTON – Resident and nonresident insurance producers in Massachusetts can charge separate, additional fees to customers when selling them policies, according to a new bulletin by the state Department of Insurance. The October bulletin was issued as a guidance for insurance producers. “Resident and nonresident insurance producers, including special insurance brokers, engaged in the solicitation, […]

Conning: Life insurers are revising investments

{October 22nd, 2013} by Warren S. Hersch

The U.S. life insurance industry is shifting its investment allocations as liquidity pressure has eased, according to a new study by Conning. “In 2012 life insurers shifted allocations to reduce holdings in common and preferred stock and increased cash, short term bonds and Schedule BA assets,” says Mary Pat Campbell, analyst at Conning. “We view […]

Insurers’ share prices trading below historical averages

{October 22nd, 2013} by Warren S. Hersch

Share prices of major life insurers are trading below their historical averages, new research shows. A report from Sterne Agee reveals that shares for nine of 13 life insurers are trading below their historical averages, the discount ranging from 62 percent to 99 percent. Just four companies Prudential Financial, Ameriprise Financial, Torchmark and Unum — are enjoying […]

Psychologically Ready To Retire?

{October 22nd, 2013} by Rodney Brooks, USA Today

Author and former financial planner Frank Maselli tells a story of a man who retired and went home to spend his days with his wife. It didn’t take long for him to become a major intrusion in his wife’s world. He told her the way she did everything was wrong, even the garden she […]

ING sizes planned offering of common stock

{October 21st, 2013} by Maria Wood

In a statement filed today with the SEC, ING U.S. revealed the size of a planned public offering of common stock currently held by ING Group. According to the company, ING Group seeks to sell 30 million shares, which would reduce its stake in ING U.S. from 71 percent to roughly 60 percent. ING U.S. […]

Prudential to Accept Non-Bank SIFI Designation

{October 21st, 2013} by Jeff Jeffrey

WASHINGTON – Prudential Financial Inc. will not challenge the Financial Stability Oversight Council’s designation of the company as a non-bank systemically important financial institution. Prudential, headed by Chief Executive Officer John Strangfeld, had until Oct. 19 to alert the FSOC if the company decided to continue fighting the non-bank SIFI designation. In June, Prudential was […]

5 Cardinal Rules Of Retirement Planning

{October 21st, 2013} by Glenn A. Herring

Whether you are currently retired or planning for retirement, there are five cardinal rules investors must follow to provide a stress-free retirement.There is an investment product that will achieve all five of these rules, automatically. Although it has been around for almost two decades, many haven’t heard of it. It is called the Fixed Indexed […]

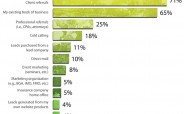

What clients want

{October 21st, 2013} by Jamie E. Green

Given the pronounced need for leads and the challenge prospecting poses to advisors, it is important to look at the methods advisors are using to prospect for new clients (Figure 7). Referrals — both client and professional — and cross-selling to existing clients figure heavily at the top of the list of methods. Advisors generally […]

Husband And Wife Sentenced For Defrauding Great-Aunt

{October 21st, 2013} by Joseph Kohut

By Joseph Kohut, The Times-Tribune, Scranton, Pa. McClatchy-Tribune Information Services Oct. 18–A husband and wife convicted of defrauding a Blakely woman and her estate were sentenced to federal prison Thursday. Victor J. Santarelli III, 47, of Clearwater, Fla., was sentenced to 57 months in prison by Senior U.S. District Judge Edwin M. Kosik and was […]

Prudential Drops Its Fight Against Systemic Risk Designation

{October 21st, 2013} by Zachary Tracer

Prudential Financial Inc., the second-largest U.S. life insurer, abandoned its challenge to a U.S. designation from a Treasury Department panel that subjects the company to increased regulatory oversight. The insurer opted against filing a lawsuit seeking to overturn its status as a systemically important financial institution, or SIFI, Newark, New Jersey-based Prudential said yesterday in […]

Proposed NAIC 2014 Budget Has $93 Million in Revenues; Funds Staff to Aid ORSA, Principles-Based Reserving Efforts

{October 21st, 2013} by Thomas Harman, associate editor, BestWeek

WASHINGTON – The National Association of Insurance Commissioners has proposed a 2014 budget showing slightly increased revenues and expenses, compared with 2013, as well as new funding for staff resources to aid the implementation of the principles-based reserving method for life insurers and the Own Risk and Solvency Assessment model act. The NAIC is projecting […]

INSURANCE REGULATION: A BIG SHIP NOW IN MOTION

{October 21st, 2013} by Elizabeth Festa and Arthur D. Postal

SIFI, NARAB, PBRs and captives — all represent major turning points for an industry in a state of regulatory reform. Read More

20 more astonishing social media statistics for financial advisors

{October 21st, 2013} by Amy Mcllwain

The recent article we did on social media statistics for financial advisors was such a hit that we decided to bring you another round with fresh data. Have you been wondering if your target demographic is using social media? Can you reach them? Do they want to interact with a financial professional on social sites? […]

What type of life insurance do life insurance agents own?

{October 21st, 2013} by Jamie E. Green

Here’s a frightening statistic: 3 percent of advisors whose primary focus is life insurance don’t own any life insurance. Only 3 percent, you might say – that’s not bad, right? That’s just 3 out of every 100 life insurance agents. Click here to read…

Deal sealed

{October 18th, 2013} by Michael K. Stanley

The announcement on Oct. 2 that Athene Holding Ltd. (Athene) had closed its acquisition of Aviva USA corp. resulting in the newly formed Athene USA was not a surprise to anyone. The deal had been closely monitored by the press, industry analysts and regulators with most concluding that the acquisition, announced Dec. 21, 2012, would […]

U.S. life insurers remain strong in difficult economy

{October 18th, 2013} by Warren S. Hersch

The U.S. life insurance industry remains financially strong despite pressures from the sluggish economic recovery and low interest rates, according to a new report. Moody’s discloses this finding in an October 2013 Special Comment: “U.S. Life Insurance: Industry Scorecard.” The report highlights the key credit factors Moody’s reviews when assessing insurers in this sector. The […]

Fixed annuity yields at banks plunge in October

{October 18th, 2013} by Maria Wood

October was a cruel month for banks selling fixed annuities. The most recent compilation from Kehrer Saltzman & Associates’s Fixed Annuity Yield Trend Report disclosed that the average yield of a fixed-rate annuity sold through banks tumbled 11 basis points to 1.88 percent in October. That drop off represents a significant reversal from the rise […]

FIO report: The hinge on insurance regulation

{October 18th, 2013} by Arthur D. Postal, Elizabeth Festa

The release of a report — one that was due more than a year ago — on how the insurance industry should be modernized has taken on new urgency. The Federal Insurance Office (FIO) report is seen as the hinge on the door of establishing a blueprint for how state, federal and international regulators can […]

2013 Insurance Industry Mergers & Acquisitions Down From 2012

{October 18th, 2013} by Fran Lysiak

Mergers and acquisition activity in the insurance industry for the first nine months of 2013 has been slower than this time last year, although the transactions are notably widespread and focused. Such activity is down from 2012 by about 100 deals, said Dan Baransky, senior vice president at Merger & Acquisition Services. He noted transactions […]

NAIC budget at $93.2 million for 2014, up 3.68%

{October 18th, 2013} by Elizabeth Festa

The new budget is in. The National Association of Insurance Commissioners (NAIC) 2014 proposed budget includes total revenues of $93.2 million, including $3.8 million in investment income and total expenses of $91.8 million, which represents a 3.68 percent and 3.87 percent increase, respectively, from the 2013 budget. It is expected to exceed the 2013 budget by […]

Former Genworth Exec Tapped to Head OneAmerica’s Individual Life, Financial Services Business

{October 17th, 2013} by Rick Cornejo

INDIANAPOLIS – Patrick M. Foley has been tapped by OneAmerica Financial Partners to be the president of individual life and financial services for OneAmerica companies. He succeeds Mark Wilkerson, who retires in 2014. Foley will lead all of the individual lines of business for the OneAmerica companies. He previously served as president of distribution and […]

Advisors Go Extra Lengths To Keep Wealthy Clients

{October 17th, 2013} by Paul Sullivan

KAREN McNEILL has a Ph.D. in history from the University of California, Berkeley, and is considered one of the foremost authorities on Julia Morgan, the architect who designed Hearst Castle, William Randolph Hearst’s 90,000-square-foot coastal retreat. Ms .McNeill has written extensively about Morgan, who designed some 700 buildings and helped open the field of architecture […]

Editor’s Note: NU, Life Insurance Selling unite

{October 17th, 2013} by Bill Coffin

Today, I have the pleasure of announcing what is not just the biggest news of my own journalism career, but the biggest news that the life & health publishing industry has received in many years. It involves big changes coming to two long-standing stalwarts of the field — National Underwriter Life & Health and Life […]

Summit Announces Launch of Summit’s Maximized Annuity Concept (MAC)

{October 17th, 2013} by PRWeb

Boca Raton, FL (PRWEB) October 16, 2013 Summit Brokerage Services announced at its National Convention the launch of Summit’s MAC, enabling all of Summit’s advisors the ability to easily weigh the potential benefits of utilizing a variable annuity in conjunction with a fixed indexed annuity to benefit their clients. “This is a concept which could […]

Five Insurance Tips For Married Couples

{October 17th, 2013} by PR Newswire Association LLC

NORTHBROOK, Ill.,Oct. 15, 2013 /PRNewswire/ — Whether you’ve dated forever or had a whirlwind romance, enjoyed a big wedding or kept it simple, one fact appears to be almost universal – those first months and years of marriage are a big adjustment. Money matters are a source of potential conflict once the honeymoon is over, […]

Michigan Names New Department of Insurance and Financial Services Head

{October 16th, 2013} by Chris McMahon

Ann Flood, who has more than 25 years of experience in legal, insurance and health care, replaces Kevin Clinton, who has been named state treasurer. Ann Flood has been appointed director of the Michigan Department of Insurance and Financial Services (DIFS) effective Nov. 1, 2013. Flood, who is currently is the department’s chief deputy director, will […]

OneAmerica Appoints New President For Individual Life And Financial Services

{October 16th, 2013} by Zarna Patel

OneAmerica appoints Patrick M. Foley as president of individual life and financial services. October 16, 2013Headquartered in Indianapolis, Ind., OneAmerica has appointed Patrick M. Foley as president of individual life and financial services (ILFS), where his focus will be on the career agency system and the asset-based care distribution channels, called CareSolution, for OneAmerica Companies. […]

Celent: Most life insurers use hosted e-signature solutions

{October 16th, 2013} by Warren S. Hersch

Life insurers are increasingly using e-signature technology to lower costs, shorten cycle times and improve the services they provide to business partners and customers. A May 2013 survey from Celent, a research advisory unit of the management consulting firm Oliver Wyman, found that 25 percent of respondents were not using e-signatures in their dealings with […]

Too easy for brokers to clean records, lawyers say

{October 16th, 2013} by Mark Schoeff Jr.

Brokers who are the subject of investor arbitration cases can clear their record of any wrongdoing too easily, according to a lawyers’ group that represents plaintiffs. A study released on Wednesday by the Public Investors Arbitration Bar Association shows that so-called expungement was granted in at least 90% of the time in the 1,625 cases […]

Google, Amazon Might Plant Big Footprints in Insurance Distribution

{October 15th, 2013} by Linda Koco

Internet superstars Google and Amazon are likely to become competitors for online insurance sales, according to predictions from life insurance and property-casualty executives polled by Accenture, a global consulting firm. The executives came from 78 European companies, but since they were commenting on digital sales trends and expectations, and since digital is global, the findings […]

Never too early to start a retirement plan

{October 15th, 2013} by Maria Wood

Young adults may think retirement is a far-off reality, but in truth, it’s never too early to start planning for one’s golden years. Proper preparation takes on greater importance in light of the fact that younger workers will have less access – if at all – to employer-sponsored pensions than their parents and grandparents. Studies have […]

Insurer ordered to turn over property records

{October 15th, 2013} by Arthur D. Postal

A Texas insurance company must submit its life insurance policyholder records to the California comptroller for scrutiny as to whether it is complying with the state’s unclaimed property laws. Judge David Brown issued an order mandating such compliance for American National Insurance Company of Galveston, Texas, Oct. 9. Brown is a judge in state Superior […]

The little mistake that could destroy a life insurance plan

{October 15th, 2013} by Ed Slott

In a recent U.S. Supreme Court case (Hillman vs. Maretta, U.S. Supreme Court, No. 11-1221, June 3, 2013) the Court ruled that a decedent’s ex-spouse, who was still named as his beneficiary, was entitled to receive his federal life insurance benefits. The decision was unanimous, despite the fact that an applicable state law says that […]

8 critical questions to prepare for FINRA suitability exams

{October 15th, 2013} by Melanie Waddell

More than a year after revamping its suitability rule, the Financial Industry Regulatory Authority has issued a study guide of sorts for broker-dealers (BDs) to help them prep for suitability exams. Notice to Members 13-31 discusses issues that have cropped up during exams in the last year, with some of the infractions serious enough to […]

Youngest IRA owners are most extreme investors

{October 15th, 2013} by Warren S. Hersch

Roth and traditional individual retirement account owners had the highest percentages of “extreme asset allocations”, according to an October 2013 report from the Employee Benefits Research Institute. The research reveals that, among all investors, Roth and traditional IRA owners had allocated in 2011 more than 90 percent of their investments into equities or more than […]

Whose Job is It to Find Financial Fraud?

{October 15th, 2013} by Targeted News Service

NATIONAL HARBOR, Md.,Oct. 14 –The Institute of Internal Auditors issued the following news release: A new report released today from the Anti-Fraud Collaboration* reveals that board members, financial executives, internal auditors, and external auditors are not completely on the same page when it comes to owning responsibility for deterring and detecting financial statement fraud. In […]

Overturned Felony Conviction Impacts All Advisors Selling Annuities

{October 15th, 2013} by Karen DeMasters

The case of a California insurance agent, whose conviction for theft was overturned by a state appeals court last week, has implications for all client-facing financial professionals, according to the Society of Financial Service Professionals (FSP). The situation points out the need for financial professionals to document their work with elderly clients, even if that […]

The habits of top life insurance producers

{October 15th, 2013} by Jamie E. Green

When the responses of advisors who reported generating more than $100,000 in life insurance premium in the past year were isolated and compared with the remaining responses, several striking differences emerged. It is important to note, however, that the data only supports a correlative rather than a causal relationship between a particular data point more […]

Summary and timeline of the Glenn Neasham case

{October 15th, 2013} by Kim O'Brien

Neasham executive summary as prepared by NAFA’s General Legal Counsel On October 8, 2013, in a unanimous, 3-0 decision, the Court of Appeal of the State of California – First Appellate District, Division Three – reversed Glenn Neasham’s theft conviction. Neasham had been convicted in 2011 in Lake County Superior Court of theft with respect […]

Allianz Life Launches New Allianz Core Income 7 Fixed Index Annuity

{October 15th, 2013} by Sara Thurin Rollin

Designed to appeal to the broker/dealer channel, fixed index annuity offers protection and lifetime income October 14, 2013 10:22 AM Eastern Daylight Time MINNEAPOLIS–(BUSINESS WIRE)– Allianz Life Insurance Company of North America (Allianz Life) today announced the launch of the Allianz Core Income 7SM Annuity with its Core Income Benefit rider1, the first Fixed Index […]

Allianz Life to launch indexed annuity for B-Ds, wirehouses

{October 15th, 2013} by Darla Mercado

Product with built-in income rider set to debut Oct. 14 Allianz Life Insurance Co. of North America is making a bigger push to get registered reps interested in indexed annuities as the carrier launches a line of products for broker-dealers and wirehouses. It plans to launch its Core Income 7 indexed annuity Oct. 14. The […]

Neasham case settled, but aftershocks continue

{October 15th, 2013} by Maria Wood

A decision this week by the California Appellate Court to overturn the conviction of Glenn Neasham for theft from an elder in connection with the sale of an annuity is a welcome result for the insurance and the financial services industry. However, the case still holds important lessons for professionals when they work with elderly […]

IICF partners with Sesame Street to improve literacy

{October 11th, 2013} by Emily Holbrook

Today, in an event held at the New York Public Library, the Insurance Industry Charitable Foundation (IICF) and Sesame Workshop (the nonprofit organization behind Sesame Street) announced the launch of their partnership in the name of early childhood literacy. “We believe that every child has the potential to be great,” said H. Melvin Ming, president […]

NAIFA Exec: LUTCF Designation Still Valid

{October 11th, 2013} by Susan B. Waters

Editor’s note: Dr. Susan Waters, chief executive officer of the National Association of Insurance and Financial Advisors (NAIFA), submitted the following response to the article, “New Certification For Life Insurance Agents Reflects Changing Needs,” that was posted on Oct. 9. To the Editors of InsuranceNewsNet, With a nod to Mark Twain, rumors of the LUTCF […]

New Certification For Life Insurance Agents Reflects Changing Needs

{October 11th, 2013} by Cyril Tuohy

You’ve had a great run, Life Underwriter Training Council Fellow (LUTCF). Now step aside, there’s a new designation in town: the Financial Services Certified Professional (FSCP). The demise of the long-standing LUTCF designation for the broader FSCP designation reflects not only lower demand for the LUTCF but a shift in the broadening of what life […]

U.S. Life Insurance Activity Off 2.5% In Sept.

{October 11th, 2013} by PR Newswire Association LLC

BRAINTREE, Mass., Oct. 9, 2013 /PRNewswire/ — U.S. application activity for individually underwritten life insurance was down -2.5% in September, year-over-year, all ages combined, according to the MIB Life Index. Third quarter results show life applications continuing to lose ground as compared to same quarter last year, off -2.3%, Q3 2013 / Q3 2012, although the […]

Female clients explain what they value in an adviser

{October 10th, 2013} by Liz Skinner

Financial planning clients want an adviser they trust, who listens closely to them and patiently explains things they have more questions about, two female clients answered in response to adviser inquiries at an industry conference. These clients, who opened up to advisers at the National Association of Personal Financial Advisors’ national conference in Philadelphia, said […]

Could ACA Be An Opportunity For Annuity Pros?

{October 10th, 2013} by Linda Koco

Annuity professionals may not view health care reform as relevant to the work they typically do with clients — needs analysis, sales, service, income planning and the like. In fact, most annuity specialists don’t sell health insurance or, if they do, it’s typically done as a sideline or as an accommodation. It’s easy to see […]

Neasham Looks to Uncertain Future Even After Winning Appeal

{October 10th, 2013} by Steven A. Morelli

The judges’ decision to overturn the conviction of theft in what was a simple annuity sale might have seemed like an obvious outcome to observers, but Glenn A. Neasham has learned the hard way not to assume anything in a court. After all, Neasham went from making more than $400,000 a year with a thriving […]

Advisers falling short when it comes to talking philanthropy with clients: Survey

{October 10th, 2013} by Darla Mercado

Though most advisers do address giving, many clients walk away unsatisfied Want to engage your clients and pave the way for a long-lasting relationship? Try discussing their philanthropic goals. Though nine out of 10 financial advisers, and trust and estate attorneys, discuss philanthropic giving with their clients, many of them are doing it wrong. […]

New DIA Market: Generation X

{October 9th, 2013} by Linda Koco

Will deferred income annuities appeal to Generation X? Some annuity watchers have been thinking “no,” but new data from the leading seller in this market suggests the answer is “yes.” Those in the “not” camp believe Gen Xers won’t buy deferred income annuities (DIAs) because most of these products are income annuities that delay payout […]

Life insurance producers: Let’s celebrate National Breast Cancer Awareness Month

{October 9th, 2013} by Josh Jackson

When you think about fall colors, what do you think of? Orange? Red? Maybe yellow? How about pink? If you did say pink, you aren’t alone. People are seeing pink all over the place — after all, October is National Breast Cancer Awareness Month. And rightly so; breast cancer is by far the most common […]

Yellen to be named by Obama first female Fed chair

{October 9th, 2013} by Bloomberg News

World’s most powerful central bank to be in the hands of a key architect of its unprecedented stimulus program President Barack Obama will nominate Janet Yellen as chairman of the Federal Reserve, which would put the world’s most powerful central bank in the hands of a key architect of its unprecedented stimulus program and the […]

Glenn Neasham case: Court reverses conviction of theft

{October 9th, 2013} by Paul Wilson

The first appellate district court of California has reversed Neasham’s conviction of committing theft from an elder and dependent adult stemming from his 2008 sale of a MasterDex 10 Annuity to then 83-year-old Fran Schuber. A document released by the court states, “Although there was conflicting evidence as to the elder’s inability to understand the […]

Former commish questions NAIC’s future role

{October 9th, 2013} by Arthur D. Postal

The National Association of Insurance Commissioners is at a crossroads because it must clarify first what it is, and then work out a system for collaborating with federal regulators in overseeing large, multifaceted insurance companies with international operations, according to a former insurance commissioner. Larry Mirel, a partner in the Washington, D.C., office of Nelson […]

2013 Life Insurance Survey: The results

{October 9th, 2013} by Jamie E. Green

This summer, the National Underwriter research team conducted a comprehensive research exploration of life insurance product sales. The purpose of this research effort was to identify opportunities, challenges and common obstacles shared by advisors selling life insurance; the expectations and needs advisors have of their distribution partners, such as insurers and marketing organizations; advisors’ product […]

Survey: Gen X seriously short on life insurance

{October 9th, 2013} by Jeff Reeves, Special for USA TODAY

In the wake of the 2008 financial crisis, middle-aged Americans are increasingly overlooking life insurance due to shaky personal finances. A New York Life survey released Thursday shows Americans born from 1965 through 1976, commonly known as Generation X, reported life insurance needs almost $449,000 greater than what their current coverage provides. And that’s just […]

Management buys out Leawood insurance marketing company

{October 8th, 2013} by James Dornbrook, Reporter - Kansas City Business Journal

Leawood-based Creative Marketing International Corp., a national marketing organization for annuities, life insurance and securities, was acquired by CM2 Holding Inc. for an undisclosed amount. CM2 Holding is a company owned by several members of the Creative Marketing management team. The new ownership team includes President Mike Tripses, COO/CFO Will Moneymaker and minority owner Mark […]

What to Know About NARAB or National Producer Licensing: Bissett of Big ‘I’

{October 8th, 2013} by Jamie Johnson

If and when the federal government resumes operations, a multistate producer licensing reform bill long pushed by the country’s insurance agent lobby could be among the few bipartisan pieces of business Congress tackles and actually passes. The National Association of Registered Agents and Brokers Reform Act of 2013, or NARAB for short, aims to streamline […]

Insurance Volunteers: Spot Opportunities With Week of Giving ‘Project Finder’

{October 8th, 2013} by Elizabeth Myatt | IICF Charitable Involvement & Leadership Blog Blog

Many people in the insurance industry want to help in their communities by serving as volunteers in their communities. But many simply don’t know how to find the right place to volunteer. Problem solved. IICF (the Insurance Industry Charitable Foundation) provides a tool for insurance volunteers — individuals and team leaders — to find projects […]

Who Must Register As A Municipal Advisor?

{October 8th, 2013} by Cyril Tuohy

A new “registration regime” recently adopted by the Securities and Exchange Commission (SEC) to regulate who is qualified to give advice and under what circumstances appears to have more exemptions than the tax code. Well, not exactly, but it’s worth pointing out who isn’t required to register as a municipal advisor now that the SEC […]

5 ways life insurance agents are increasing sales in 2014

{October 8th, 2013} by Corey Dahl

Recently, we asked hundreds of producers to tell us how they expected their life insurance sales to fare over the next 12 months, relative to the previous year. The answer? The overwhelming majority is planning to see a nice bump. Click here to read…

The Great Unknowns

{October 8th, 2013} by Kate Smith

Four words have been sparking debate throughout the insurance industry: systemically important financial institution. Three years ago, with the passage of the Dodd-Frank Wall Street Reform Act, Congress gave the Federal Reserve Board authority to oversee companies deemed by the Financial Stability Oversight Council to be “systemically important financial institutions.” Click here to read…

Lawsky bars hedge fund giant from insurance business

{October 8th, 2013} by Elizabeth Festa

Forbes calls Philip A. Falcone a former Harvard hockey player billionaire but the New York Superintendent of Financial Services is calling him banned from the business. Superintendent Ben Lawsky ordered hedge fund impresario Falcone barred from exercising direct or indirect control over the management, policies, operations, and investment funds of Fidelity & Guaranty Life Insurance Co. […]

Transamerica reaches multistate life claim settlement

{October 7th, 2013} by Noah Guillaume

Florida reached a life claim settlement agreement with Transamerica Life Insurance Company (Transamerica) and its affiliates. All of the settlements concentrate on the insurers’ asymmetrical use of the U.S. Social Security Death Master File (DMF) and the practice of using it to stop paying a deceased person’s annuity, but not using it to search for […]

Sale of Aviva USA at higher price a credit positive

{October 7th, 2013} by Michael K. Stanley

With the Oct. 2 completion of the sale of Aviva USA Corp. (Aviva USA) to Athene Holding Ltd (Athene), Aviva Plc (Aviva) was able to move on after a nine-month-long regulatory dance. The British insurer let go of its U.S. life and annuities business for $2.3 billion, $800 million more than the initially announced price […]

The ‘lost generation’ of retirement planning

{October 7th, 2013} by Michael K. Stanley

Despite dour prognostications regarding baby boomers’ retirement preparedness post financial crisis, a recent research report finds that there are other segments of the population who are in deeper trouble when it comes to retirement planning — like Millennials. In its third annual research report on the state of U.S. employee retirement preparedness, Financial Finesse, an unbiased […]

The importance of enthusiasm

{October 7th, 2013} by Van Mueller

A successful sales career requires study and practice, but it also requires enthusiasm and faith. The most important sale you will ever make in this business is to yourself. You must believe in what you do with every fiber of your being in order to achieve success and inspire clients to take action. Click here […]

Income Rocks! Guaranteed Retirement Income Rocks!

{October 7th, 2013} by Jamie Johnson

Most workers really WANT to have guaranteed retirement income and they’ll give up some of their salary for it. InsuranceNewsNet Magazine shared with us in their August 2013 edition: Guaranteed Retirement Income Rocks A lot of workers really want to have a guaranteed income in retirement, so much that they are willing to pull the […]

A.M. Best Removes Ratings of Global Atlantic Financial Group’s Subsidiaries From Under Review

{October 4th, 2013} by Best's News Service

OLDWICK, N.J. – A.M. Best Co. has removed from under review with negative implications and affirmed the financial strength rating (FSR) of A- (Excellent) and issuer credit ratings (ICR) of “a-” of Commonwealth Annuity and Life Insurance Company (Commonwealth) and its subsidiary, First Allmerica Financial Life Insurance Company (FAFLIC) (both domiciled in Southborough, MA). A.M. […]

A.M. Best Downgrades Ratings of Aviva Life and Annuity Company and Its Subsidiary

{October 4th, 2013} by A.M. Best

CONTACTS: Anthony McSwieney Senior Financial Analyst (908) 439-2200, ext. 5715 anthony.mcswieney@ambest.com William Pargeans Assistant Vice President (908) 439-2200, ext. 5359 william.pargeans@ambest.com Rachelle Morrow Senior Manager, Public Relations (908) 439-2200, ext. 5378 rachelle.morrow@ambest.com Jim Peavy Assistant Vice President, Public Relations (908) 439-2200, ext. 5644 james.peavy@ambest.com FOR IMMEDIATE RELEASE OLDWICK, N.J., OCTOBER 03, 2013 A.M. Best […]

Goldman Touches the FIA Market

{October 4th, 2013} by Kerry Pechter

Bermuda-based Global Atlantic Financial Group, a multiline insurer and reinsurer whose principal owner is Wall Street powerhouse Goldman Sachs, is expanding its footprint in the life insurance industry by acquiring privately-held Forethought Financial Group Inc., which offers variable annuities, fixed annuities and fixed indexed annuities, as well as funeral insurance. By buying Houston-based Forethought, Global […]

Former Commissioners Warn NAIC In Danger Of ‘Falling Apart’

{October 4th, 2013} by Jeff Jeffrey

The National Association of Insurance Commissioners is in danger of “falling apart” under mounting pressure from international regulators to better coordinate the regulation of insurance, three former insurance commissioners told attendees of the National Risk Retention Association’s annual conference in Washington. Charles Cohen, a former insurance director in Arizona who is now an attorney at […]

Rep. Royce again questions NAIC’s authority

{October 4th, 2013} by Arthur D. Postal

The National Association of Insurance Commissioners should answer tough questions about what it is and the true scope of its authority, according to a senior member of the House Financial Services Committee. Rep. Ed Royce, R-Calif., who is also chairman of the House Foreign Affairs Committee, said in a speech before the National Risk Retention […]

Apollo completes Aviva USA deal for $2.6 billion

{October 4th, 2013} by Victor Epstein

New York-based Apollo Global Management completed its purchase of Aviva USA on Wednesday for $2.6 billion. The West Des Moines-based insurer is being incorporated into the private equity firm’s “Athene” insurance arm, and being rechristened “Athene USA.” The deal for Aviva USA has been pending since December, when Apollo won a bidding war for the […]

Fiduciary rules will cost millions in compliance

{October 4th, 2013} by Paula Aven Gladych

Huge changes – including millions of dollars in compliance costs to the brokerage industry and higher costs to investors – are in store if the Department of Labor and Securities and Exchange Commission decide to adopt a uniform fiduciary standard. It may be weeks, if not longer, before that decision is finalized but the question […]

Global Atlantic closes on Aviva USA’s life business

{October 4th, 2013} by Michael K. Stanley

Global Atlantic Financial Group (Global Atlantic) announced Oct. 2 that its wholly-owned subsidiary, Commonwealth Annuity and Life Insurance Co., completed its acquisition of Aviva USA’s life insurance arm from Athene Holding Ltd. The finalization of the deal comes on the same day that British insurer, Aviva Plc, completed the sale of its U.S. life and […]

Athene closes on Aviva USA deal

{October 4th, 2013} by Maria Wood

It took nine months and a lot of regulatory wrangling, but Athene Holding Ltd. has closed on its acquisition of Aviva USA Corp. The new entity, now to be known as Athene USA, will make its headquarters in West Des Moines, Iowa, and operate as Athene’s U.S. arm. The purchase price, first set at $1.55 […]

Turning ‘friends’ into clients

{October 4th, 2013} by Davis D. Janowski

Real-life stories of advisers and their social-media strategies As more and more advisers use social media in their practices, a truth is becoming obvious — the most successful are careful never to lay on a hard sell. Instead, they use social-media outlets such as Twitter and Facebook to make personal connections with like-minded people, many […]

Insight: Check the Fine Print. There’s more to IULs than what some sellers represent.

{October 4th, 2013} by M. David Greenberg

Source: Best’s Review (August 2013 Issue) As most everyone in the life insurance industry knows, Indexed Universal Life is the fastest growing life insurance product of recent years, and the pace even appears to be picking up. Not surprisingly, a parade of insurance company wholesalers and company execs stream through our office urging […]

Athene Chief: No ‘Time-Fuse’ On Aviva Deal

{October 4th, 2013} by Linda Koco

Now that Athene Holding Ltd. has completed its $1.55 billion purchase of Aviva USA, the company is setting its sights on being a leader in the fixed annuity business. That’s the word from Athene’s Grant Kvalheim, who is president of the Pembroke, Bermuda, holding company. In a phone interview, Kvalheim repeatedly stressed that Athene plans […]

California Congressman Calls NAIC ‘$80 Million Trade Association’

{October 3rd, 2013} by Jeff Jeffrey

WASHINGTON – U.S. Rep. Ed Royce, R-Calif., said he intends to hold a hearing to investigate the National Association of Insurance Commissioners and its role in the insurance marketplace, which he said has gone far beyond what the NAIC has the legal authority to do. Royce told attendees of the National Risk Retention Association’s annual […]

Protective Life Acquires MONY Life and Reinsures Closed Life Book for $1.06 Billion

{October 3rd, 2013} by Fran Lysiak

BIRMINGHAM, Ala. – Protective Life Insurance Co. has completed its acquisition of MONY Life Insurance Co. and has reinsured certain policies of MONY Life Insurance Company of America for a total price of $1.06 billion. In April, Protective Life, a unit of Protective Life Corp. (NYSE: PL) announced it would buy MONY Life Insurance, a […]

How one woman fell in love with the insurance industry

{October 2nd, 2013} by Maria Wood

Nancy Coutu studied finance and economics in college, but she never imagined that more than 30 years later she would find herself in the financial services field. “I was always very interested in it and thought I would pursue something in it, but never dreamed I would be in this career,” she admits. Yet like […]

Advisers to furloughed workers: Take a deep breath, stay calm

{October 2nd, 2013} by Liz Skinner and Mark Schoeff Jr.

And don’t forget about why you set up that rainy day fund; ‘nobody’s panicked yet’ On the second day of the federal government shutdown, financial advisers with clients who have been furloughed are trying to ease their concerns about cash and reminding them of their rainy-day funds. “Nobody’s panicked yet,” said Jessica Ness, a client […]

The European life insurance market: On its last legs?

{October 2nd, 2013} by Emily Holbrook

For years now, the life insurance market here in the U.S. has been suffering from diminished returns due to low interest rates. The effect is, according to some, much worse across the pond, however. Recent news from Linklaters, a global law firm with an insurance specialization, says that the “current climate has produced a perfect […]

Selling Annuities As An Accumulation Strategy

{October 2nd, 2013} by John Williams CLU,® Regional Sales Director

John Williams CLU,® Regional Sales Director Published in the September 2013 issue of Broker World, reprinted with permission Fixed index annuities combine insurance protection with growth potential, but guaranteed lifetime withdrawal benefits may miss the mark More than 79 million baby boomers1 are just starting to reach retirement age. Not only are they contemplating the […]

Nearly Half Of Americans Struggle To Find Trusted Financial Advice

{October 2nd, 2013} by Targeted News Service

NEW YORK,Oct. 1 — TIAA-CREF issued the following news release: TIAA-CREF, a leading financial services provider, released findings today from its second annual Financial Advice Survey, revealing that almost half of Americans say it is hard to know which sources of financial advice can be trusted. The survey was conducted by an independent research firm […]

John Hancock Completes Acquisition Of Symetra Investment Services

{October 2nd, 2013} by John Hancock Financial Network

BOSTON, Oct. 1, 2013 /PRNewswire/ –John Hancock, a unit of Manulife Financial Corporation (MFC), today announced the completion of its acquisition of Bellevue, Wash.-based Symetra Investment Services, Inc. from Symetra Financial Corporation (SYA). Terms were not disclosed. Symetra Investment Services (SIS), a dual registered broker-dealer/registered investment adviser, is now part of John Hancock Financial Network […]

3 steps to building a multicultural business

{October 2nd, 2013} by Ed McCarthy, CFP

To build your practice for tomorrow, you should be tapping into the country’s growing multicultural populace today. According to December 2012 projections by the U.S. Census Bureau, minorities, now 37 percent of the population, are projected to comprise 57 percent of the population in 2060. That increased diversity encompasses more than just ethnicity and race, […]

NAIFA: Inside build-up will escape tax reform

{October 2nd, 2013} by Warren S. Hersch

The 1,500-plus assembled attendees at the National Association of Insurance and Financial Advisors’ annual meeting had reason to applause Monday. “The word is not yet final, but we are told that inside build-up will not be part of the pending tax reform legislation,” declared Danea Kehoe, an outside counsel for NAIFA at DBK Consulting. Official or […]

A.M. Best Affirms Ratings of Ameriprise Financial, Inc. and Its Subsidiaries

{October 1st, 2013} by Best's News Service

OLDWICK, N.J. – A.M. Best Co. has affirmed the financial strength rating (FSR) of A+ (Superior) and issuer credit ratings (ICR) of “aa-” of RiverSource Life Insurance Company (Minneapolis, MN) and its wholly owned subsidiary, RiverSource Life Insurance Company of New York (Albany, NY). A.M. Best also has affirmed the FSR of A (Excellent) and […]

NAIFA says prepare for legislative battles ahead

{October 1st, 2013} by Warren S. Hersch

Legislative and regulatory threats to the industry, and actions that are needed to counter them, were the focus of Sunday’s opening general session of the National Association of Insurance and Financial Advisors’ annual meeting and career conference, held in San Antonio. NAIFA’s leadership team, from the CEO on down, used the occasion to call on […]

Powerful Regulator And Industry Spar Over Reserving Requirements

{October 1st, 2013} by Cyril Tuohy

A move by New York’s top financial services regulator to pull out of principal-based reserving (PBR) regulations has life insurers irate at the prospect of having to increase their reserves by billions of dollars to pay claims on life insurance products. This latest dust-up in the eternal battle between insurance companies and the 50 state […]

A Possible Break On The Inside Buildup Threat

{October 1st, 2013} by Linda Koco

SAN ANTONIO – There is a possibility that taxing the inside buildup of life insurance products will not be included in the tax reform package being developed in Congress, according to Danae Kehoe, a member of the National Association of Insurance and Financial Advisors (NAIFA) government relations team. The news brought NAIFA members to their […]

Legacy Launches AdvanceMarkSM Ultra Series of Annuities

{October 1st, 2013} by Diane Shemi

Offers tremendous upside potential, up to 10% vesting bonus, and robust income rider PETALUMA, CA, September 30, 2013—Legacy Marketing Group® is excited to announce the launch of AdvanceMark Ultra Series flexible premium deferred fixed indexed annuities issued by Fidelity & Guaranty Life Insurance Company. A redesign of the popular AdvanceMark Series FIAs, this new series’ […]

Global Atlantic to acquire Forethought Financial

{October 1st, 2013} by Michael K. Stanley

Last week, when Global Atlantic Financial Group (Global Atlantic) announced that they would be acquiring Forethought Financial Group, Inc. (Forethought) for an undisclosed amount, many industry-watchers and analysts concluded that it was an unsurprising move for a company that has been increasingly active lately. Global Atlantic, the multiline insurance and reinsurance company that in May […]

Government ‘shuts down’

{October 1st, 2013} by David Espo

WASHINGTON (AP) — For the first time in nearly two decades, the federal government staggered into a partial shutdown Monday at midnight. Congressional Republicans demanded changes in the Patient Protection and Affordable Care Act (PPACA). President Barack Obama and Democrats refused. Click here to read…

Impact Partnership Acquires Retirement Income Network

{October 1st, 2013} by The Impact Partnership

The Fastest-Growing Marketing Organization Just Became Faster ATLANTA, Oct. 1, 2013 /PRNewswire/ — The fastest-growing marketing organization in the insurance and annuities industry, Impact Partnership, has just acquired the industry’s exclusive Digital Marketing Organization (DMO), Retirement Income Network (RIN Marketing). “As the first DMO in the annuities industry, RIN has the expertise necessary to grow […]