THIRD QUARTER 2021 ANNUITY SALES

November 30, 2021 by Sheryl J. Moore

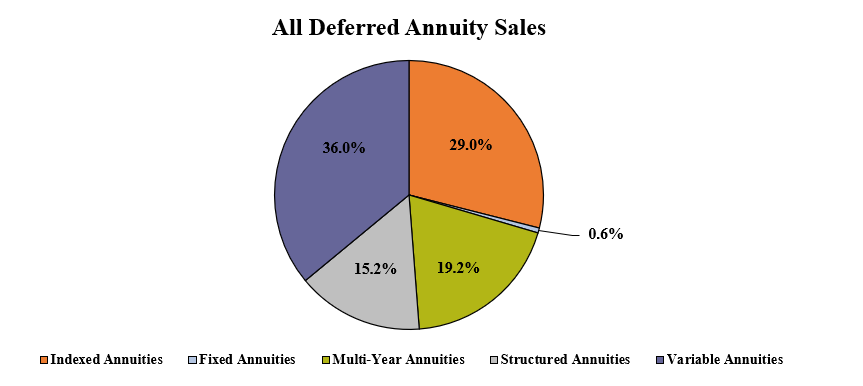

Deferred Annuity Sales

Total 3Q2021 deferred annuity sales are $59,889 million, compared with sales of $54,217 million for the third quarter of 2020. Third quarter deferred annuity sales were down more than 7% when compared to the previous quarter and up more than 10% when compared to the same period last year. Deferred annuities include sales of fixed, indexed, multi-year guaranteed, structured and variable deferred annuities.

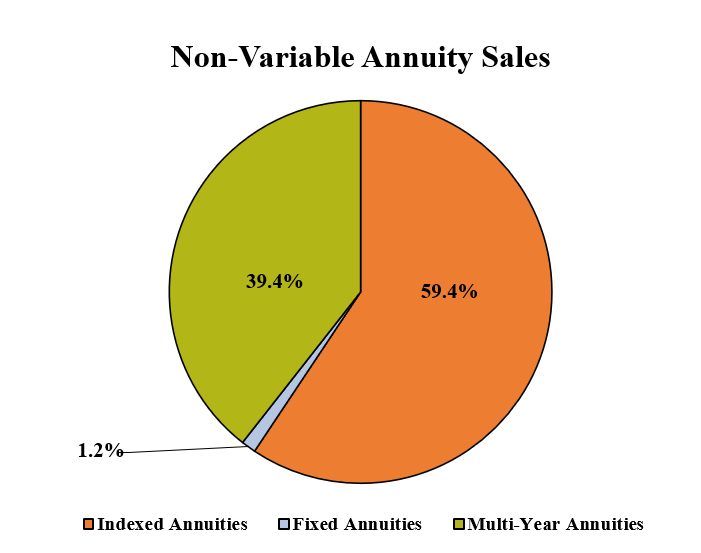

Non-Variable Deferred Annuity Sales

Total 3Q2021 non-variable deferred annuity sales were $29,217 million, compared with sales of $30,932 million for the third quarter of 2020. Third quarter non-variable deferred annuity sales were down more than 7% when compared to the previous quarter, and down nearly 6% when compared to the same period last year. Non-variable deferred annuities include sales of fixed, indexed, and multi-year guaranteed deferred annuities.

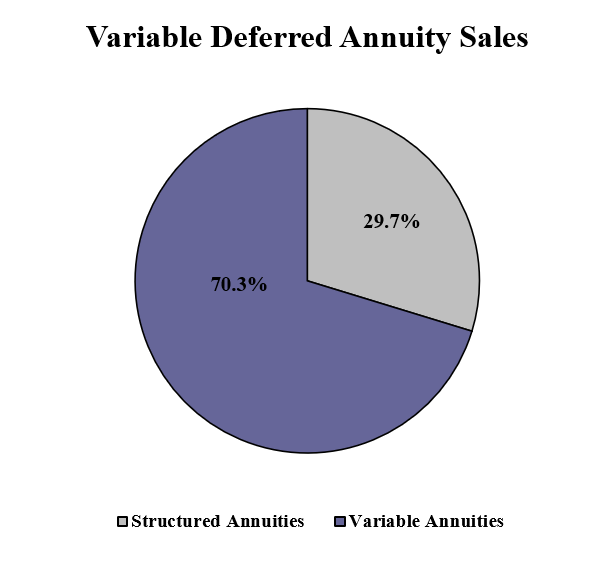

Variable Deferred Annuity Sales

Total 3Q2021 variable deferred annuity sales were $30,672 million, compared with sales of $23,284 million for the third quarter of 2020. Third quarter variable deferred annuity sales were down nearly 7% when compared to the previous quarter, and up nearly 32% when compared to the same period last year. Variable deferred annuities include sales of structured and variable deferred annuities.

Indexed Annuity

Sales for the third quarter of 2021 were $17,341 million, compared with sales of $13,798 million for the third quarter of 2020. Third quarter indexed annuity sales were up 4% when compared to the previous quarter, and up nearly 26% when compared to the same period last year.

Total 3Q2021 indexed annuity sales were $17,341,224,278.

THE TOP TEN INDEXED ANNUITY CARRIERS FOR THE THIRD QUARTER OF 2021:

- Allianz Life

- Athene USA

- AIG

- Fidelity & Guaranty Life

- Sammons Financial Companies

- SILAC Insurance Company

- American Equity Companies

- Massachusetts Mutual Life Companies

- Global Atlantic Financial Group

- Nationwide

AVERAGE COMMISSION:

The indexed annuity commission received by the agent averaged 6.34% of premium for the third quarter of 2021; a trend that is up 0.69% from prior quarter.

LEADERS BY CHANNEL:

Bank- AIG

Career- CNO Companies

Direct Response- N/A

Independent Agent- Allianz Life

Independent Broker Dealer- Allianz Life

National Broker Dealer- AIG

Registered Investment Advisor- Massachusetts Mutual Life Companies

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Allianz Life Allianz Benefit Control Annuity

Bank- American General Power Index 5 Plus Annuity

Career- C.M. Life Index Horizons

Direct Response- N/A

Fee-Based Overall- American General Power Index Advisory IA

Independent Agent- Allianz Life Allianz Benefit Control Annuity

Independent Broker Dealer- Allianz Life Allianz Benefit Control Annuity

National Broker Dealer- American General Power Index 5 Plus Annuity

Registered Investment Advisor- Great American Index Protector 5 MVA

Fixed Annuity

Sales for the third quarter of 2021 were $360 million, compared to sales of $488 million for the third quarter of 2020. Third quarter fixed annuity sales were down nearly 22% when compared to the previous quarter, and down more than 26% when compared with the same period last year.

Total 3Q2021 fixed annuity sales were $360,762,277.

THE TOP TEN FIXED ANNUITY CARRIERS FOR THE THIRD QUARTER OF 2021:

- Global Atlantic Financial Group

- Jackson National Life

- American National

- EquiTrust

- AIG

- Brighthouse Financial

- National Life Group

- OneAmerica

- Massachusetts Mutual Life Companies

- CNO Companies

AVERAGE COMMISSION:

The fixed annuity commission received by the agent 5.76% of premium for the third quarter of 2021; a trend that is down 0.01% when compared to last quarter.

LEADERS BY CHANNEL:

Bank- OneAmerica

Career- CNO Companies

Direct Response- AIG

Independent Agent- Global Atlantic Financial Group

Independent Broker Dealer- Brighthouse Financial

National Broker Dealer- Global Atlantic Financial Group

Registered Investment Advisor- N/A

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Forethought Life ForeCare Fixed Annuity

Bank Forethought Life ForeCare Fixed Annuity

Career- Bankers Life & Casualty Bonus Annuity

Direct Response- N/A

Fee-Based Overall- N/A

Independent Agent- Forethought Life ForeCare Fixed Annuity

Independent Broker Dealer- Forethought Life ForeCare Fixed Annuity

National Broker Dealer- Forethought Life ForeCare Fixed Annuity

Registered Investment Advisor- N/A

Multi-Year Guaranteed Annuity

Sales for the third quarter of 2021 were $11,515 million, compared with sales of $16,645 million for the third quarter of 2020. Third quarter MYGA sales were down more than 20% when compared to the previous quarter, and down nearly 31% when compared to the same period last year.

Total 3Q2021 MYGA sales were $11,515,761,192.

THE TOP TEN MYGA CARRIERS FOR THE THIRD QUARTER OF 2021:

- Massachusetts Mutual Life Companies

- New York Life

- Global Atlantic Financial Group

- AIG

- Symetra Financial

- Western-Southern Life Assurance Company

- Oceanview Life and Annuity Company

- Fidelity & Guaranty Life

- Sagicor Life

- American Equity Companies

AVERAGE COMMISSION:

The multi-year guaranteed annuity commission received by the agent averaged 1.80% of premium for the third quarter of 2021; a decline of 0.07% from last quarter.

LEADERS BY CHANNEL:

Bank- Global Atlantic Financial Group

Career- New York Life

Direct Response- Puritan Life

Independent Agent- Sagicor Life

Independent Broker Dealer- American Equity Companies

National Broker Dealer- Massachusetts Mutual Life Companies

Registered Investment Advisor- Security Benefit Life

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Massachusetts Mutual Life Stable Voyage 3-Year

Bank- Forethought Life SecureFore 3 Fixed Annuity

Career- Thrivent Financial Security One

Direct Response- Puritan Life Canvas 3-Year

Fee-Based Overall- Security Benefit Life Advanced Choice Annuity 4-Year

Independent Agent- Sagicor Life Milestone MYGA 5-Year

Independent Broker Dealer- Eagle Life Eagle Guarantee Focus 3

National Broker Dealer- Massachusetts Mutual Life Stable Voyage 3-Year

Registered Investment Advisor- Security Benefit Life Advanced Choice Annuity 4-Year

Structured Annuity

Sales for the third quarter of 2021 were $9,117 million compared with sales of $6,252 million for the third quarter of 2020. Third quarter structured sales were down nearly 8% when compared to the previous quarter, and up nearly 46% when compared to the same period last year.

Total 3Q2021 structured annuity sales were $9,117,866,702.

THE TOP TEN STRUCTURED ANNUITY CARRIERS FOR THE THIRD QUARTER OF 2021:

- Equitable Financial

- Allianz Life

- Brighthouse Financial

- Prudential

- Lincoln National Life

- RiverSource Life

- CUNA Mutual Life

- Athene USA

- Nationwide

- Symetra Financial

LEADERS BY CHANNEL:

Bank- Equitable Financial

Career- RiverSource Life

Direct Response- N/A

Independent Broker Dealer- Allianz Life

National Broker Dealer- Allianz Life

Registered Investment Advisor- Lincoln National Life

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Pruco Life Prudential FlexGuard Indexed VA Plus

Bank- Equitable Financial Structured Capital Strategies Plus

Career- RiverSource Life Structured Solutions 6-Year

Direct Response- N/A

Fee-Based Overall- Lincoln National Life Lincoln Level Advantage Advisory

Independent Broker Dealer- Pruco Life Prudential FlexGuard Indexed VA

National Broker Dealer- Allianz Life Allianz Index Advantage

Registered Investment Advisor- Lincoln National Life Lincoln Level Advantage Advisory

Variable Annuity

Sales for the third quarter of 2021 were $21,554 million, compared with sales of $17,032 million for the third quarter of 2020. Third quarter variable annuity sales were down nearly 7% when compared to the previous quarter, and up nearly 27% when compared to the same period last year.

Total 3Q2021 variable annuity sales were $21,554,163,664.

THE TOP TEN VARIABLE CARRIERS FOR THIRD QUARTER OF 2021:

- Jackson National Life

- Nationwide

- Equitable Financial

- Lincoln National Life

- Pacific Life Companies

- New York Life

- AIG

- RiverSource Life

- Thrivent Financial

- Brighthouse Financial

LEADERS BY CHANNEL:

Bank- Jackson National Life

Career- Equitable Financial

Direct Response- Fidelity Investments

Independent Broker Dealer- Jackson National Life

National Broker Dealer- Jackson National Life

Registered Investment Advisor- Lincoln National Life

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Bank- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Career- Equitable Financial Equi-Vest

Direct Response- Fidelity Fidelity Personal Retirement Annuity

Fee-Based Overall- Fidelity Fidelity Personal Retirement Annuity

Independent Broker Dealer- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

National Broker Dealer- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Registered Investment Advisor- Lincoln National Life ChoicePlus Assurance Series B

Wink anticipates compiling fourth quarter, 2021’s sales with a release date of April 2022.