Insurance Company Executive Compensation: Not What You Would Expect

August 31, 2023 by Sheryl J. Moore

There are a couple of things that have put the matter of life insurance company executive compensation front and center with me over the past couple of months.

First- I recently had the opportunity to read an article from Life Annuity Specialist regarding the extreme pay being collected by the head of a sleepy little indexed annuity company in West Des Moines. It caused me to do a double-check because:

1). I recall the year that this company’s CEO broke a salary of $100,000, not 20 years ago.

2). The current CEO’s compensation is purportedly 384 times greater than the aforementioned CEO’s. (P.S. That is not a typo- 384X.)

3). The insurance company has a 1.22% market share of the $284 billion deferred annuity market.

AND-

4). This company is paying its chief executive more than the CEO of State Farm makes.

So, yeah, you’ve got my attention.

Secondly, the Wall Street Journal was interested in executive compensation in the financial services industry, around the same time the LAS story was published. WSJ published an article on the “14 Highest-Paid CEOs in Financial Services,” which caused me to conclude that the aforementioned highly-compensated CEO was not only the highest-paid insurance CEO of 2022 but that his pay also exceeded that of JPMorgan Chase’s CEO, Jamie Dimon.

I found THAT especially curious, given the indexed annuity company’s CEO pay, relative to the sales of the company.

**SN: Kudos to the gentleman who negotiated that package, just three years ago. **

The conversations that ensued, as a result of me posting these two articles on my LinkedIn feed, were lively and engaging. In the end, I had more questions than answers. Ultimately, it left me feeling that I needed to research the matter of executive compensation at life insurance companies.

My friend and mentor, Joseph Belth, was an excellent researcher in the life insurance industry. Long since retired, his monthly The Insurance Forum periodical set him apart as a thought leader in our business. From researching the rising cost of insurance lawsuits to reporting on insurance companies that were cutting inforce rates, you could count on an insightful, thorough (and often controversial) read with each issue of his publication.

Of great interest, each year Professor Belth would publish the total compensation of dozens of insurance companies. This is information that is difficult to obtain. I know of two insurance departments that collect this information, but I am unaware of any resource that publishes the data, much less since Belth’s retirement. Today, I undertook the task myself.

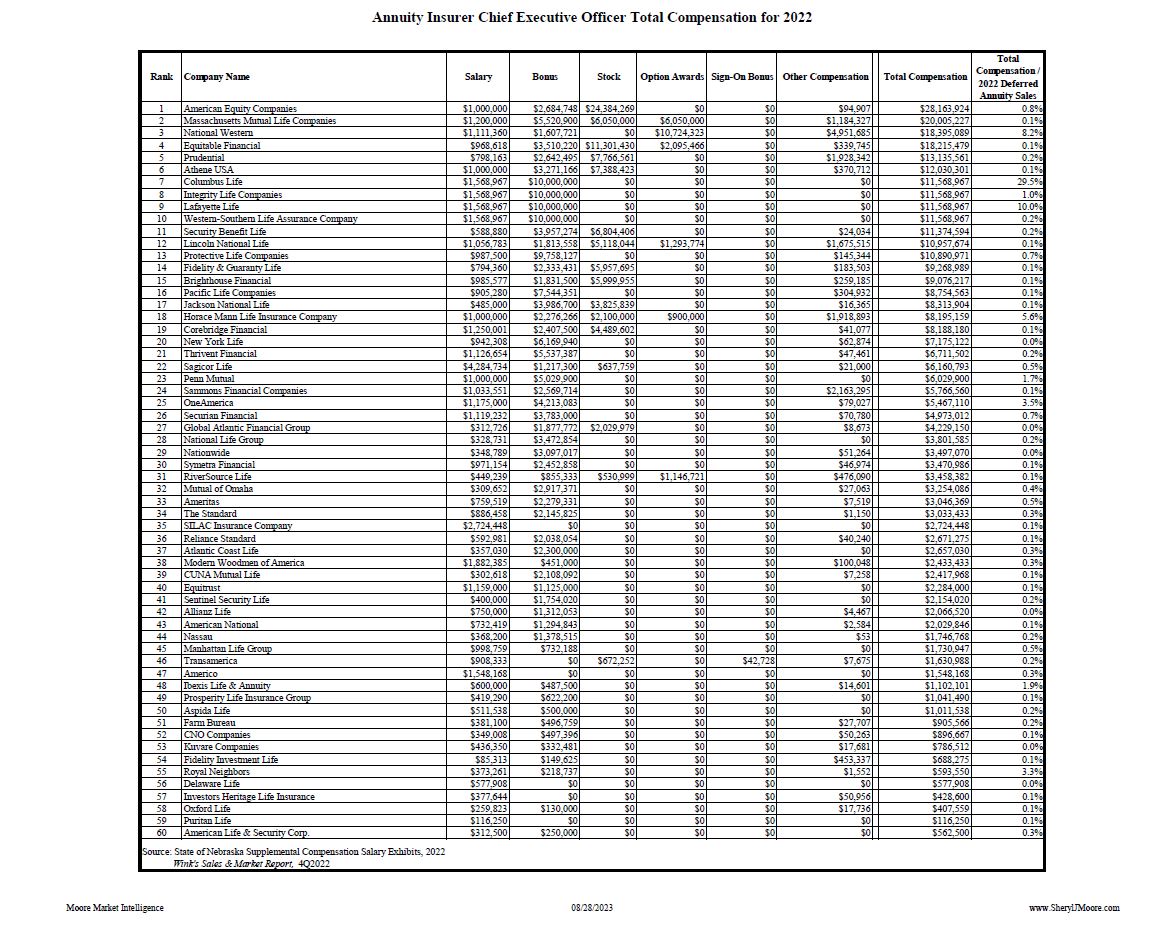

I obtained the data to fuel my research from the state of Nebraska’s insurance regulator. All data collected was from 2022. My task- to compare the pay of 60 chief executives at the companies that report their deferred annuity sales to Wink’s Sales & Market Report. In all, I was able to review the salaries, bonuses, stock, and other types of compensation for these insurance companies. The results of my research were surprising in many ways.

Before we dig in, I have a caveat. Some insurance conglomerates pay their CEOs for each insurance company held; others are paid one salary for managing all companies under the corporate umbrella. We have no means to disclose when this is the case, as each insurance company conglomerate handles it differently. These two methods are not differentiated in the regulatory exhibits. When reviewing the results, some of these may become apparent (i.e., four companies each pay their common CEO exactly the same salary, bonus, and stock options). Just please keep this in mind.

—– • —–

Upon review of the data, the first thing that caught my attention was that these CEO’s salaries were not as high as I anticipated. The average take-home in 2022 was $882,991 for the year, with a high of $4,284,734 paid. Interestingly, the bonuses paid were comparatively greater than salaries; with an average bonus of $2,682,385, and a high of $10,000,000. Not shockingly, the stock portion of compensation made up the lion’s share of the compensation package, with a mean of $1,584,287, and a high of $24,384,269. However, overall compensation averaged $5,808,845 for the year, with the highest-paid CEO pulling in $28,163,924.

That’s no small cookies.

What was really interesting, while reviewing the data, was the realization that stockheld insurance companies, who were NOT owned by private equity (PE), paid their executives nearly four times more than their PE counterparts. And while mutual CEOs made about half of the stockheld CEOs’ pay, fraternal CEOs made about 20% of what their mutual colleagues did.

I decided that it would be interesting to try and correlate each CEO’s pay to some value that is representative of the company’s effectiveness, or “success.” I used 2022’s deferred annuity sales, as reported in Wink’s Sales & Market Report, as a measure of the company’s relative achievement. There were companies that paid their CEOs a minute fraction of their annuity sales. There were others who paid their CEOs as much as one-third of the company’s sales. One can only assume that in these instances the relative sales success of other lines of business, outside of deferred annuities, is a contributing factor to these individuals’ compensation. Overall, CEOs averaged total compensation that was 1.2% of the company’s deferred annuity sales reported.

I’ve published the results from the compensation exhibits, view PDF and results: Deferred Annuity CEO Comp. Enjoy, and I’ll try to begin gathering this data annually.

P.S. I hope my CEO friends are able to use this data as leverage! -sjm